The term ‘oracle’ has become quite commonly used within crypto circles across the globe in recent years, and rightly so. This is because these novel offerings are designed to connect various blockchain projects with a wide array of off-chain data, thus allowing for the advent of many novel use Slot Gacor.

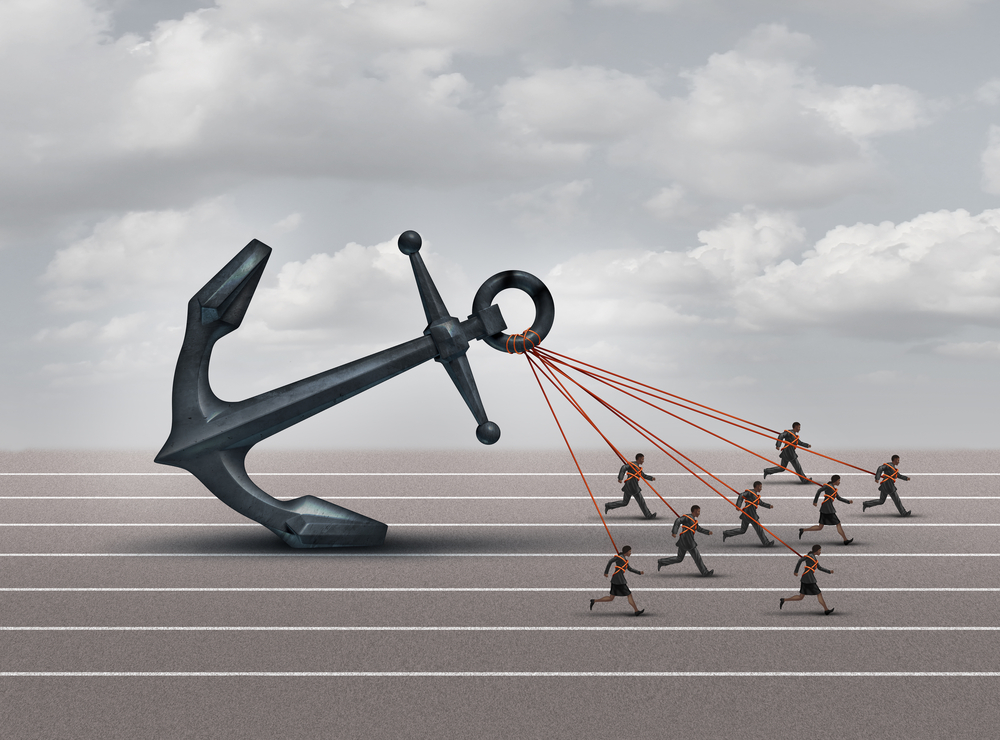

That said, most traditional oracles are faced with two core issues. Firstly, they require a centralized entity/intermediary to facilitate their access to external, real-time data — as a result of which third parties can potentially alter the data being supplied to it. Secondly, centralized oracles often have to forego many of the privacy advantages put forth by smart contracts, thereby posing major risks to the system’s overall security.

A smart contract can be thought of as a program/transaction protocol designed to automatically execute, administer and note relevant events and actions as per the terms of a predefined digital agreement.

Decentralized oracles explained

As highlighted earlier, centralized oracles serve as single, stand-alone entities that provide data from an external source to a smart contract operating within a set governance framework. As a result, they, more often than not, feature a single point of failure that can result in them being corrupted or being attacked.

On the other hand, decentralized oracles can be visualized as a group of independent oracles where each node operating within the network is capable of acting on its own accord — i.e., having the ability to work solo and retrieve data from an off-chain source.

Since they don’t have any sort of dependence on a “single source of truth”, the overall authenticity, and veracity of the data being supplied to the associated smart contract can be verified with an extremely high degree of efficacy.

To elaborate, most high-quality Decentralized Oracle Networks (DONs) provide their clients with highly specific security features such as data integrity proofs (that use cryptographic signatures); data validation modules using multi-layer aggregation (so as to eliminate downtime-related issues); crypto-economic Situs Slot Gacor as well as other optional features such as zero-knowledge proofs.

From an operational standpoint, decentralized oracles are ideal for use within a complex business environment but need a high level of financial investment — especially when it comes to setting up the project’s native infrastructure as well as paying for its general upkeep/maintenance.

The issues with oracles in their present form

While the transparency and decentralization aspect of most oracle-based platforms is quite intriguing, at least on paper, it should be noted that such propositions are only valid insofar that the information being supplied to a particular blockchain is “tamper-proof”. Now that being said, it is worth looking into the question of who really has the power to authenticate this data?

In fact, this question has been looked at in-depth by many blockchain experts and arises whenever a digital asset has to be linked to its physical counterpart.

As an example, whenever the transfer of ownership relating to a physical commodity (for example a necklace) has to take place between two people, the smart contract associated with the deal has to be supplied with data ensuring the validity of the supplied information.

To achieve this, a third party is usually required for the verification of events taking place in the real world. And while many projects have sought to alleviate this pain point in recent years, the issue is still quite prevalent today.

Decentralized Oracle solutions

Chainlink

One of the most popular oracle networks in the market today, Chainlink is best described as a decentralized network of nodes capable of delivering its users a wide range of real-time info from external data sources. The platform’s native smart contract architecture is automated and is able to perform actions as and when certain predefined conditions are satisfied.

Chainlink’s network is designed to help process real-world data associated with a number of feeds ranging from asset prices to sports data to shipping data to weather data. As a result of its multifaceted utilitarian structure, the platform is currently being used by a number of prominent DeFi projects such as Aave, Kyber Network, Synthetix, amongst others.

QED

QED can be thought of as a future-ready decentralized oracle designed to connect a wide number of blockchain networks and their associated smart contracts with external data sources seamlessly. Operationally speaking, QED Oracles utilize ‘external collateral’ as a bond to their smart contract theory mitigating many systemic risks that may have otherwise entered the fray.

Furthermore, the platform uses a ‘reliability scoring’ mechanism that determines the oracle’s capital efficiency while weeding out any poor performers from within the ecosystem. Lastly, QED has been built atop a blockchain that features no single point of failure and does not make use of a centralized verification system — allowing for a higher level of operational efficacy and overall security.

Witnet

Simply put, Witnet is a decentralized oracle network (DON) that not only connects smart contracts to real-world data sources but also allows third-party software to gather certain, specific info published by a given web address at any given point in time in its lifecycle, that too with verifiable proof.

It is worth mentioning that Witnet comes with a highly developed, holistic blockchain as well as a native digital asset that miners have the option of securing in lieu of retrieving, attesting and delivering web content.

True Decentralization Can be Achieved With Oracles