Markets are cyclical, and move in a variety of patterns that can often give insight into what phase of a market cycle an asset like Bitcoin might be in.

But could time also play an important factor as to when market cycles come to the climax? Evidence suggests that the crypto market is especially sensitive to market timing, and in the past December has marked a distinct top or bottom. If this evidence is correct, and a pattern is potentially valid, will Bitcoin price top or bottom at the end of this year?

Bitcoin Price At An Impasse, When Will The Range Break?

Bitcoin price is still stuck around the low $30,000 range – an inflection point and confusing stage of the current market cycle. The leading cryptocurrency spent the majority of the last 15 months bullish, but as of three months ago the market turned.

Related Reading | Predicting The Crypto Bull Top And Bear Bottom With Ichimoku

But rather than being a cycle top, the price chart more resembles a mid-point of the bull run, or perhaps wave four out of five – with the last leg up being one for the history books.

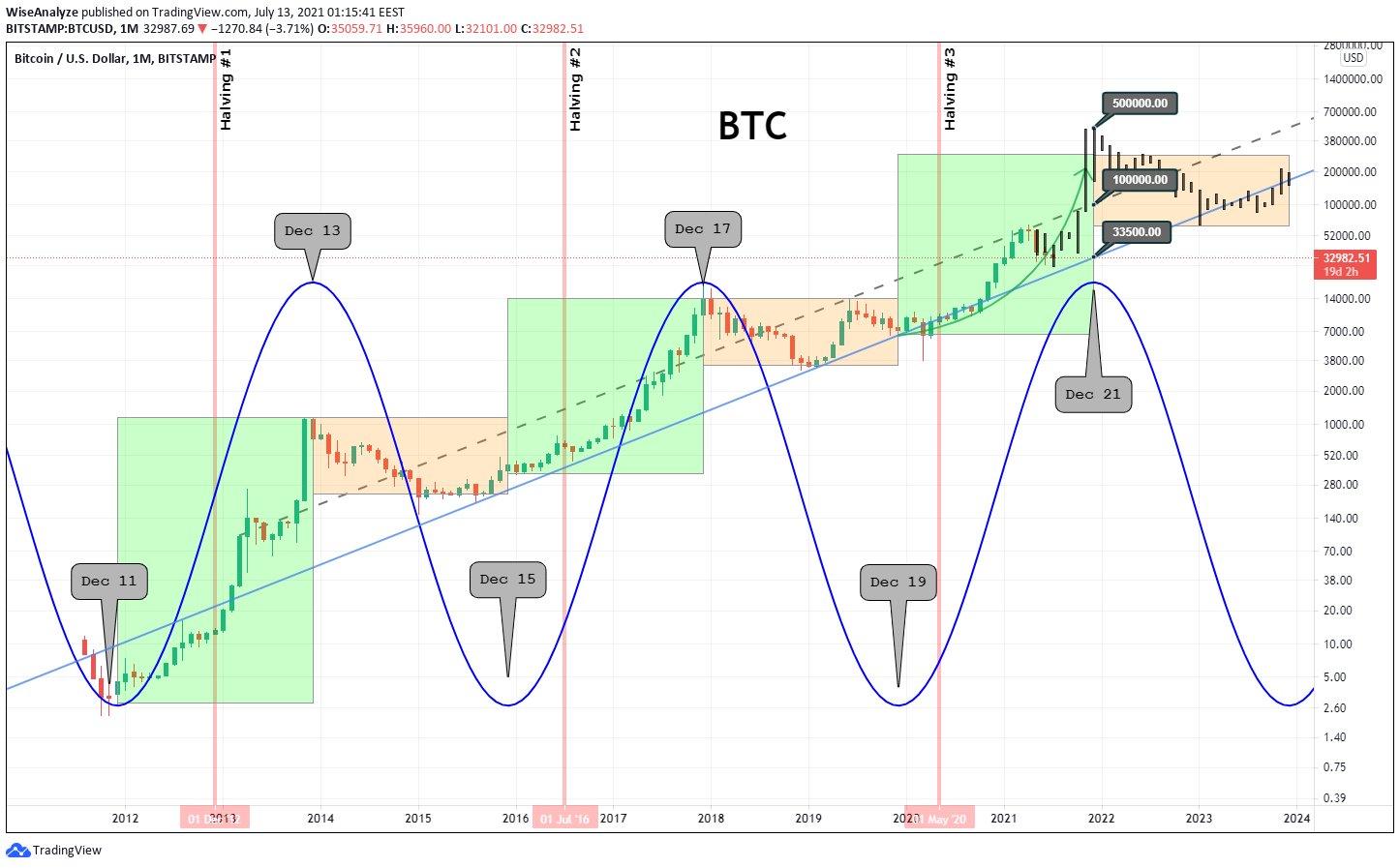

Adding more credence to the theory, is a chart shared by a crypto analyst who uses “sine lines” to call out distinct tops and bottoms in Bitcoin that take place every other December.

Will BTC peak in December 2021? Sine waves suggests so | Source: BTCUSD on TradingView.com

Every December is one to remember in Bitcoin, dating all the way back to the first time Bitcoin reached above $1,000. It promptly fell 80% to under $200 by the following December, where it reached its bear market bottom.

Two years later, in December 2017, Bitcoin price topped out once again, putting an end to that bull rally and starting another bear market. The bottom of that bear market was – you guessed it – in December. A temporary “bottom” was even set in December 2019 before a rejection resulted in Black Thursday last year.

In December 2020? Bitcoin price was blasting through former resistance at all-time high – a level it never looked back at, but is now less than $12,000 away.

Related Reading | Why The Next Bitcoin Bear Market Will Be The Worst Yet

The sine lines depicted in the chart above would suggest that Bitcoin price would potentially top out again, later this year. That would mean the current “peak” was merely a local top, and that the bull rally will soon resume.

According to Wikipedia, a sine line or sine wave “is a continuous wave” and is “named after the function sine.” It is in essence a mathematical curve that describes a “smooth periodic oscillation.” More importantly, is it found all throughout nature – notably in wind, sound, and light. But what about time?

Time and price is little more than various forms of mathematics, that pulses in waves. Before you dismiss any theories about December, remember, the sine wave around the end of this year and if the math adds up, Bitcoin price should be a lot higher.

Featured image from iStockPhotos, Charts from TradingView.com