Cryptocurrencies have revolutionized the financial landscape, introducing decentralized and secure transactions. However, this innovative technology has come under scrutiny for its significant energy consumption, particularly with proof-of-work-based cryptocurrencies like Bitcoin. As the demand for cryptocurrencies rises, so does the concern over the environmental impact of energy-intensive mining processes. This article aims to explore the trade-offs between security and sustainability in cryptocurrency networks and the ongoing efforts to strike a balance.

Understanding Cryptocurrency Networks

Cryptocurrency networks are revolutionary digital ecosystems built on blockchain technology. In these decentralized systems, transactions are recorded on a distributed ledger across a network of computers, eliminating the need for intermediaries like banks. The fundamental concept of a cryptocurrency network revolves around creating a secure, transparent, and immutable ledger of transactions.

Blockchain technology, the foundation of cryptocurrency networks, consists of blocks containing batches of transactions. Each block is linked to the previous one through cryptographic hashes, forming an unchangeable chain. This design ensures the integrity of the entire transaction history and makes it incredibly challenging for malicious actors to tamper with the data.

Cryptocurrencies operate on various consensus mechanisms, such as Proof of Work (PoW) and Proof of Stake (PoS). PoW relies on miners who compete to solve complex mathematical puzzles, while PoS allows validators to create new blocks based on the number of coins they hold and “stake” in the network.

These decentralized and trustless cryptocurrency networks have revolutionized finance, offering users greater financial autonomy and the potential for global financial inclusion.

The Energy Consumption Challenge

Hurdles to Sustainability

Hurdles to sustainability in cryptocurrency networks primarily stem from their energy-intensive nature. The mining process, especially in proof-of-work-based cryptocurrencies, demands significant computational power, leading to substantial energy consumption. This high energy usage raises environmental concerns, as it contributes to carbon emissions and strains natural resources. As the popularity of cryptocurrencies grows, addressing the challenge of sustainability becomes crucial to minimize their ecological impact. The industry is actively exploring innovative solutions and adopting energy-efficient technologies to overcome these hurdles and strike a balance between security and environmental responsibility.

Environmental Concerns

The increasing energy consumption has raised environmental concerns. Critics argue that the carbon footprint of cryptocurrency mining contributes to climate change and exacerbates the global energy crisis. As a result, many individuals and organizations are pushing for more sustainable alternatives. Environmental concerns in cryptocurrency networks arise from their substantial energy consumption and associated carbon footprint. The energy-intensive mining process, particularly in proof-of-work-based cryptocurrencies, has drawn criticism for its impact on climate change and natural resources. As the global demand for cryptocurrencies increases, so does the environmental impact, raising questions about the industry’s long-term sustainability. To address these concerns, the cryptocurrency community is exploring greener alternatives, such as renewable energy sources for mining operations and the development of more energy-efficient consensus mechanisms. Finding solutions to mitigate the environmental impact is vital to ensure a more sustainable future for the cryptocurrency industry.

Security and Decentralization in Cryptocurrencies

Proof of Work (PoW) vs. Proof of Stake (PoS)

Two primary consensus mechanisms used in cryptocurrency networks are Proof of Work (PoW) and Proof of Stake (PoS). PoW relies on miners solving complex mathematical puzzles to validate transactions, while PoS allows validators to create new blocks based on the number of coins they “stake.”

Proof of Work (PoW) and Proof of Stake (PoS) are two primary consensus mechanisms used in cryptocurrency networks to validate transactions and create new blocks. In PoW, miners compete to solve complex mathematical puzzles, and the first one to find the solution gets the right to add the next block to the blockchain. This process requires substantial computational power, leading to high energy consumption.

In contrast, PoS relies on validators who are chosen to create new blocks based on the number of coins they “stake” or hold in the network. Validators are incentivized to act honestly, as they risk losing their staked coins if they attempt to validate fraudulent transactions. Both mechanisms have their merits and drawbacks, and their adoption depends on the specific goals and requirements of each cryptocurrency network. PoW is known for its security and robustness, while PoS offers energy efficiency and scalability advantages.

The Role of Miners

Miners play a crucial role in the security and integrity of the blockchain. Their computational power ensures that the network remains robust and resistant to malicious attacks. The role of miners in cryptocurrency networks is crucial to the security and integrity of the blockchain. Miners are participants who use powerful computer hardware to validate transactions and add new blocks to the blockchain. In proof-of-work-based cryptocurrencies, miners compete to solve complex mathematical puzzles, and the first one to find the solution gets the right to add the next block. Their computational power ensures that the network remains robust and resistant to malicious attacks. Miners play a vital role in maintaining the decentralized nature of the cryptocurrency network and ensuring the trustworthiness of transactions by confirming their validity through consensus mechanisms like proof of work.

Environmental Impact of Cryptocurrency Mining

Carbon Footprint of Bitcoin

Bitcoin, being the first and most popular cryptocurrency, has faced the most criticism regarding its energy consumption. Some reports estimate that Bitcoin mining consumes more energy than entire countries.

Renewable Energy Solutions

To address environmental concerns, the industry is exploring renewable energy sources to power cryptocurrency mining operations. Green mining initiatives aim to reduce the carbon footprint associated with mining activities.

Innovations and Sustainable Alternatives

Blockchain Scalability

One potential solution to reduce energy consumption is to improve blockchain scalability. By enhancing the efficiency of transaction processing, energy requirements could be significantly reduced.

Layer 2 Solutions

Layer 2 solutions, like the Lightning Network for Bitcoin, aim to handle smaller transactions off-chain, thereby alleviating the burden on the main blockchain and reducing energy usage.

Governmental Regulations and Incentives

Governmental bodies worldwide are considering regulations to manage energy-intensive cryptocurrency mining. Some regions offer incentives for miners to use renewable energy sources or employ greener technologies.

The Role of Community and Corporate Responsibility

The cryptocurrency community and industry players have an essential role to play in promoting sustainable practices. Emphasizing responsible energy consumption and environmental stewardship can drive positive change.

Benefits

- Reduced Environmental Impact: Energy-efficient cryptocurrencies consume less energy during mining, leading to a smaller carbon footprint and reduced contribution to climate change.

- Lower Energy Costs: Energy-efficient networks require less power to validate transactions, resulting in reduced mining costs for participants and lower fees for users.

- Increased Scalability: Energy-efficient consensus mechanisms and technologies allow for improved scalability, enabling cryptocurrency networks to handle higher transaction volumes efficiently.

- Enhanced Security: Despite consuming less energy, energy-efficient cryptocurrencies maintain robust security features, ensuring the integrity of transactions and protecting against malicious attacks.

- Sustainable Innovation: By prioritizing energy efficiency, the cryptocurrency industry fosters sustainable innovation, encouraging the development of greener technologies and practices.

- Positive Public Perception: Energy-efficient cryptocurrencies are perceived more favorably by environmentally conscious individuals and institutions, potentially attracting a broader user base and investment.

- Governmental Support: Governments may be more inclined to support energy-efficient cryptocurrencies due to their reduced impact on the environment, potentially leading to favorable regulations and incentives.

- Long-Term Viability: Energy-efficient networks are more likely to have long-term viability, as they align with global efforts to address climate change and promote sustainability.

- Social Responsibility: Embracing energy efficiency in the cryptocurrency sector demonstrates social responsibility, showcasing the industry’s commitment to mitigating environmental challenges.

- Global Adoption: As awareness of energy-efficient cryptocurrencies grows, more users and businesses may adopt these networks, contributing to their global acceptance and integration into everyday transactions.

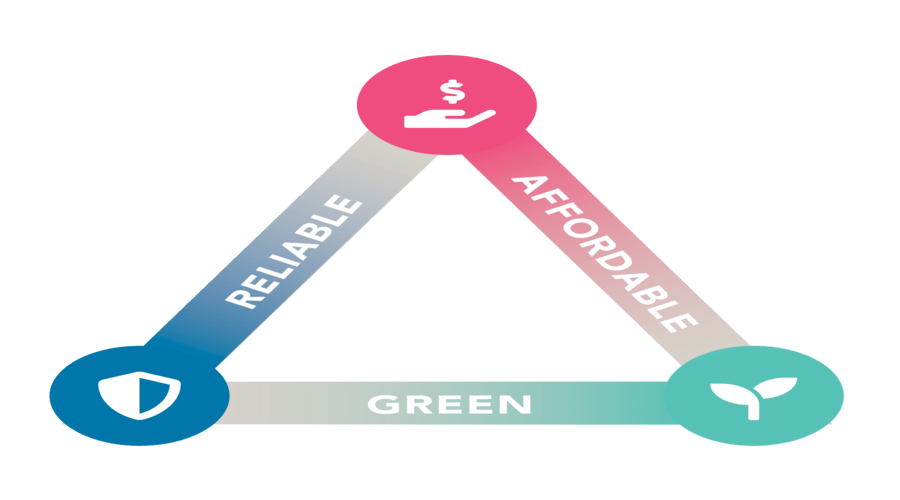

Striking a Balance: Security and Sustainability

Collaborative Approaches

Achieving a balance between security and sustainability requires collaboration between various stakeholders. Miners, developers, governments, and users must work together to find innovative solutions.

Long-Term Viability

Cryptocurrency networks must consider their long-term viability by adopting sustainable practices that do not compromise security or decentralization.

The Future of Energy-Efficient Cryptocurrencies

Technological Advancements

Continuous technological advancements will likely lead to more energy-efficient consensus mechanisms and mining hardware.

Broader Adoption

As cryptocurrencies gain wider adoption, the demand for energy-efficient networks will increase, incentivizing the development of greener alternatives.

Conclusion

Balancing the energy consumption trade-offs in cryptocurrency networks is a complex but critical task. It requires technological innovation, governmental cooperation, community involvement, and a long-term commitment to sustainability. By addressing these challenges, the cryptocurrency industry can pave the way for a more secure and environmentally friendly future.

FAQs

- Is cryptocurrency mining harmful to the environment? Cryptocurrency mining, particularly in the case of proof-of-work cryptocurrencies, can have a substantial environmental impact due to high energy consumption. However, the industry is exploring sustainable alternatives to mitigate its carbon footprint.

- Can renewable energy be used for cryptocurrency mining? Yes, many cryptocurrency mining operations are shifting towards renewable energy sources as part of their commitment to sustainability.

- What is the difference between proof of work and proof of stake? Proof of work relies on computational puzzles, while proof of stake depends on validators staking their coins to validate transactions and create new blocks.

- How can the cryptocurrency community promote sustainable practices? The community can promote sustainability by advocating for greener mining practices, supporting energy-efficient networks, and raising awareness about the environmental impact of cryptocurrencies.

- What does the future hold for energy-efficient cryptocurrencies? The future looks promising, with ongoing technological advancements and increased awareness driving the development of more energy-efficient cryptocurrencies.