Cryptocurrency exchanges play a vital role in the world of digital currencies, facilitating the buying, selling, and trading of various cryptocurrencies. As the popularity and value of cryptocurrencies continue to rise, ensuring the security of user funds has become a paramount concern for these exchanges. One crucial method employed to protect user funds is cold storage.

Understanding Cold Storage

Cold storage refers to the practice of keeping cryptocurrency assets offline in a highly secure manner. By storing funds in an offline environment, cold storage significantly reduces the risk of unauthorized access, hacking, and theft. Unlike hot wallets, which are connected to the internet and susceptible to cyber attacks, cold storage provides an extra layer of protection for long-term storage.

Cold storage refers to the practice of storing cryptocurrencies in an offline and secure environment, disconnected from the internet. It is a method used to enhance the security of digital assets by keeping private keys and funds offline, away from potential online threats such as hacking and cyber attacks. Cold storage solutions include paper wallets, hardware wallets, offline computers, and multi-signature wallets. By utilizing cold storage, individuals and organizations can significantly reduce the risk of unauthorized access and theft, providing a reliable and secure means of storing cryptocurrencies for long-term preservation.

Importance of Cold Storage for Cryptocurrency Exchanges

The importance of cold storage for cryptocurrency exchanges cannot be overstated. With hackers and cybercriminals constantly seeking ways to exploit vulnerabilities in the digital landscape, securing user funds has become a top priority. By utilizing cold storage, exchanges can ensure that even if their online systems are compromised, user funds remain safe and secure.

Cold storage is of utmost importance for cryptocurrency exchanges to ensure the security and protection of user funds. Here are the key reasons why cold storage is crucial in the cryptocurrency exchange ecosystem:

- Enhanced Security: Cold storage keeps the private keys and user funds offline, significantly reducing the risk of hacking, cyber attacks, and unauthorized access. It provides an additional layer of protection against digital threats.

- Protection against Online Vulnerabilities: By keeping funds offline, cold storage mitigates the risk of vulnerabilities associated with online platforms and hot wallets. It minimizes the exposure to potential breaches and exploits in the digital realm.

- Prevention of Theft and Loss: Storing cryptocurrencies in cold storage safeguards them from theft, whether through hacking or physical means. It reduces the risk of loss due to accidents, hardware failures, or malicious activities.

- Long-Term Storage Solution: Cold storage is ideal for long-term storage of cryptocurrencies that are not intended for immediate transactions. It ensures that user funds are safely preserved for extended periods without compromising security.

- Compliance with Regulatory Requirements: Many jurisdictions require cryptocurrency exchanges to implement robust security measures to protect user funds. Cold storage solutions help exchanges meet regulatory compliance standards and demonstrate their commitment to safeguarding user assets.

- Building Trust and Confidence: By prioritizing the security of user funds through cold storage, exchanges can enhance trust and confidence among their user base. This promotes a positive reputation and attracts more users to engage in cryptocurrency trading on their platform.

- Disaster Recovery and Resilience: Cold storage offers a reliable backup option in the event of system failures, natural disasters, or other unforeseen circumstances. It enables exchanges to recover user funds and continue operations smoothly.

- Insurance and Risk Management: Cold storage solutions are often eligible for insurance coverage, providing an added layer of protection against potential losses. This helps manage risk and provides users with an additional level of assurance.

Different Types of Cold Storage

There are various types of cold storage solutions available to cryptocurrency exchanges. Let’s explore some of the most common ones:

Paper Wallets

Paper wallets involve generating a public and private key pair and printing them on paper. These wallets are completely offline and offer a high level of security. However, they can be vulnerable to physical damage or loss.

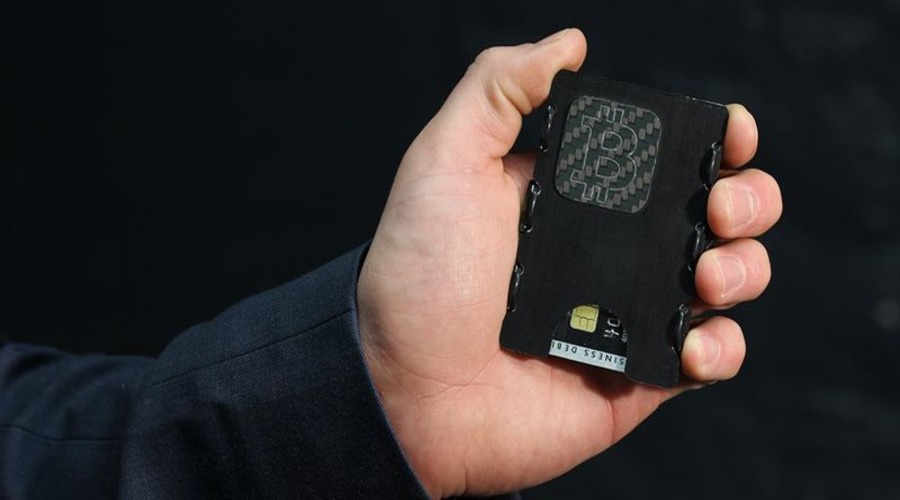

Hardware Wallets

Hardware wallets are physical devices designed specifically for securely storing cryptocurrencies. These wallets keep the private keys offline and require users to physically connect the device to initiate transactions, providing an added layer of security.

Offline Computers

Some exchanges choose to store their users’ funds on dedicated offline computers. These computers are never connected to the internet, minimizing the risk of hacking. However, this method requires robust security measures to protect the offline systems themselves.

Multi-Signature Wallets

Multi-signature wallets require multiple signatures to authorize a transaction. This type of cold storage solution distributes control over the funds among multiple parties, reducing the risk of a single point of failure.

Best Practices for Implementing Cold Storage

Implementing cold storage effectively requires following best practices to ensure maximum security. Here are some key considerations:

Generating Secure Private Keys

Cryptographic algorithms should be used to generate strong and secure private keys. Implementing a reliable random number generator and utilizing industry-standard encryption techniques are essential.

Secure Storage Solutions

Physical storage solutions, such as safes or vaults, should be used to protect offline devices or paper wallets. These storage solutions should have additional security measures in place, such as access controls and surveillance systems.

Regular Audits and Penetration Testing

Exchanges should conduct regular audits and penetration testing to identify and address any vulnerabilities in their cold storage systems. This helps ensure that the security measures are up to date and effective.

Limiting Access and Utilizing Multi-Factor Authentication

Access to cold storage should be restricted to authorized personnel only. Multi-factor authentication methods, such as biometrics or hardware tokens, can provide an extra layer of protection against unauthorized access.

Challenges and Risks of Cold Storage

While cold storage is highly effective in securing user funds, it is not without its challenges and risks. Some of the key challenges include:

Physical Threats

Cold storage solutions can be vulnerable to physical threats, such as theft, fire, or natural disasters. Adequate physical security measures should be implemented to mitigate these risks.

Human Error

Mistakes made during the generation or handling of private keys can lead to irreversible loss of funds. Proper training and strict protocols should be in place to minimize the potential for human error.

Regulatory Compliance

Cryptocurrency exchanges must comply with various regulations and standards. Implementing cold storage solutions requires adherence to these requirements to ensure legal compliance.

Balancing Security and Accessibility

While cold storage is essential for long-term security, exchanges also need to balance security with the accessibility required for day-to-day operations. This balance can be achieved by utilizing hot wallets for immediate transactions and keeping a smaller portion of funds in cold storage for long-term storage.

The Future of Cold Storage

As the cryptocurrency industry continues to evolve, so too will the methods and technologies used for cold storage. Advances in hardware security, cryptographic algorithms, and decentralized storage solutions are likely to shape the future of cold storage, making it even more robust and user-friendly.

The future of cold storage in the realm of cryptocurrencies is poised to witness significant advancements and innovation. As the digital asset landscape continues to evolve, several factors are expected to shape the future of cold storage.

One area of development is the improvement in hardware security. Hardware wallets, which are widely used for cold storage, are likely to become even more robust and tamper-proof, incorporating advanced encryption techniques and additional security features. This would enhance the overall security and reliability of cold storage solutions.

Moreover, cryptographic algorithms used for generating private keys are anticipated to become more sophisticated and resistant to hacking attempts. As cryptographic technology advances, it will contribute to the overall strength of cold storage systems.

Another aspect to consider is the emergence of decentralized storage solutions. With the rise of blockchain technology, decentralized storage platforms offer the potential for secure and distributed cold storage. Utilizing blockchain’s inherent immutability and redundancy features, decentralized storage solutions could provide enhanced security and protection for user funds.

Additionally, advancements in secure multi-party computation and threshold cryptography may pave the way for new approaches to cold storage. These techniques allow for secure management of private keys without the need for a single point of trust, distributing control among multiple parties.

Overall, the future of cold storage is likely to witness continuous innovation and development, driven by the growing need for robust security measures in the cryptocurrency industry. These advancements will further strengthen the protection of user funds, instilling confidence and trust in the digital asset ecosystem.

Conclusion

Cold storage plays a critical role in safeguarding user funds on cryptocurrency exchanges. By implementing secure and reliable cold storage solutions, exchanges can provide users with peace of mind, knowing that their funds are protected from cyber threats. As the industry continues to grow and evolve, it is crucial for exchanges to stay updated with the latest security practices to ensure the safety of user funds.

FAQs

1. How does cold storage differ from hot storage?

Cold storage refers to storing cryptocurrencies offline, whereas hot storage involves keeping them online and accessible for immediate transactions.

2. Can I use a hardware wallet with multiple cryptocurrencies?

Yes, hardware wallets generally support multiple cryptocurrencies, offering a convenient and secure storage solution for various digital assets.

3. What happens if I lose access to my cold storage?

Losing access to cold storage can be problematic since the private keys are essential for accessing funds. It is crucial to follow proper backup procedures and store recovery information securely.

4. Are there any insurance options for cold storage?

Some cryptocurrency exchanges and custodial service providers offer insurance coverage for cold storage, providing an added layer of protection against potential losses.

5. How often should I perform audits on my cold storage solution?

Regular audits should be conducted to assess the security and effectiveness of your cold storage solution. The frequency may vary depending on industry best practices and regulatory requirements. It is recommended to consult with security professionals to determine the appropriate audit schedule.